This article was written by Brandon Smith and originally published at Birch Gold Group

Perhaps one of the most bizarre recent developments in economic news has been the attempt by establishment media (and the White House) to declare US inflation “defeated” despite all the facts to the contrary. Keep in mind that when these people talk about inflation, they are only talking about the most recent CPI, which is supposed to be a measure of current inflation growth, not a measure of inflation already accumulated. But, the CPI is easily manipulated, and focus on that index alone is a tactic for misleading the public on the true economic danger.

The way current US inflation is presented might seem like a fiscal miracle. How did America cut CPI so quickly while the rest of the world including Europe is still dealing with continuing distress? Is “Bidenomics” really an economic powerhouse?

No, it’s definitely not. I have addressed this issue in previous articles but I’ll dig into inflation specifically, because I believe a renewed inflationary run is about to spark off in the near term and I suspect the public is being misinformed to keep them unprepared.

First, lets be clear that there are four types of inflation – Creeping, walking, galloping and hyperinflation. We also should distinguish between monetary inflation and price inflation, because they are not always directly related (usually they are, but events outside of money printing can also cause prices to go up).

If we calculate CPI according to the same methods used during the stagflationary crisis of the 1980s, real inflation has been in the double digits for the past couple years. This constitutes galloping inflation, a very dangerous condition that can lead to a depression event.

There are multiple triggers for the inflation spike. The primary cause was tens-of-trillions of dollars in monetary stimulus created by the Federal Reserve, the majority of which took place on the watch of Barack Obama and Joe Biden (there have been multiple GOP Republicans that have also supported these measures, but the majority of dollar devaluation is directly related to Democrat policies). This epic “too big to fail” stimulus created an avalanche effect in which economic weakness accumulated like sheets of ice on a mountainside. The final straw was the covid lockdowns and the $8 trillion+ in stimulus packages pumped directly into the system. Then, it all came crashing down.

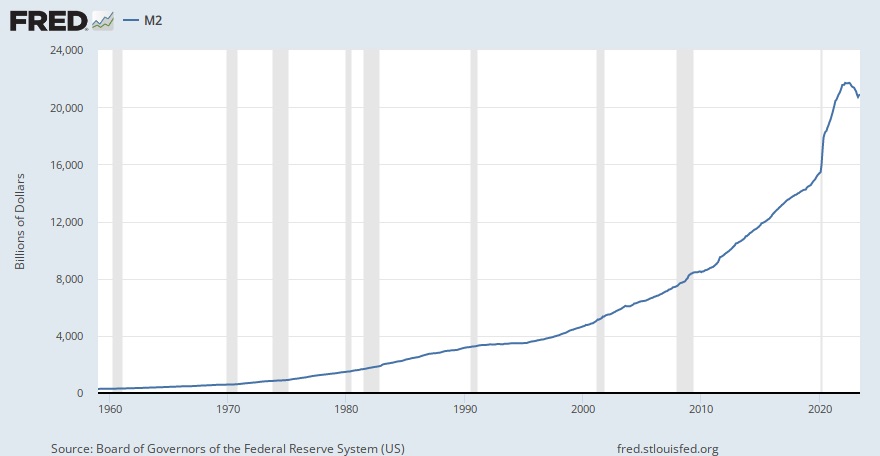

To give you a sense of how bad the situation is, we can take a look at the Fed’s M2 money supply (they stopped reporting the more complete M3 money supply right before the crash of 2008). According to the M2, the amount of dollars in circulation jumped around 40% in the span of only two years. That is an epic amount of money creation and I would argue that the economy still hasn’t processed all of it yet.

There have been too many dollars chasing too few goods and services. Thus, prices rise dramatically, with the cost of necessities increasing by 25%-50%. Think about that for a moment…it now costs us 25%-50% more per year to live than it did before 2020, and it’s not over by a long shot. Houshold costs are still climbing, and since inflation is cumulative we will likely never be rid of the increases that are already in place. But if that’s the reality, why is CPI going down?

The main reason has been the central bank pumping up interest rates. The more expensive debt becomes, the more the economy slows down. That said, the Fed has remained hawkish for a reason; they know that inflation is not going away. They need help if they’re going to convince the public that inflation is no longer a problem.

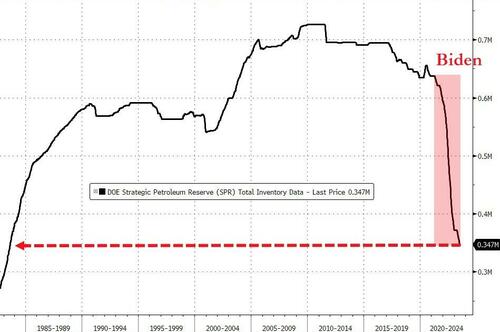

Enter Biden’s scheme of dumping America’s strategic oil reserves on the market as a means to artificially bring down CPI. Energy prices affect almost all other aspects of the CPI index, and when energy costs fall this make it seem like inflation has been tamed. The problem is that it’s a short term fraud. Biden has run out of reserves to dilute the market and the cost of refilling them is going to be exponentially higher. This is why you now see gas prices rising again and they will probably keep rising through the rest of the year.

On top of this there are also geopolitical factors to consider. The White House has earmarked over $100 billion in aid to Ukraine – A proxy war is one good way to circulate fiat dollars overseas as a means to reduce monetary inflation at home, but it’s not going to be enough unless the war expands considerably. Then there is the problem of export disruptions.

For example, Russia is now officially and aggressively shutting down Ukraine’s wheat and grain exports, which is going to cause another price spike in wheat and all foods that use wheat. India just shut down major exports of rice to protect their domestic supply, meaning rice is going to rocket in price. And, there’s an overall trend of foriegn creditors quietly dumping the US dollar as the world reserve currency. All those dollars will eventually make their way back to the US, meaning an even larger money supply circulating domestically with higher inflation as a result.

The Fed doesn’t necessarily have to keep printing for inflation to persist, they just had to set the chain reaction in motion. The recent Fitch downgrade of the US credit rating is not going to help matters as it encourages foreign investors to dump the dollar and treasuries even faster.

To be sure, there is still the matter of the battle between deflationary factors vs inflationary factors. In October, the last vestiges of covid stimlus measures will finally die, including the moratorium on student loan debt payments – That’s trillions of dollars of loans pulling billions in payments each year.

Not only that, but when those loans were put on hold, millions of people magically had their credit ratings rise, which means they had access to higher credit card limits and a vast pool of debt. Now, that’s all going away, too. No more living off Visa and Mastercard means US retail is about to take a considerable hit along with the jobs market.

Then there’s the Fed’s interest rate hikes which are now about as high as they were right before the crash of 2008. The same hikes that helped cause the spring banking crisis (which is also not over). The US will be paying record interest on the national debt, consumers will be using far less credit and banks will be lending less and less money.

So yes, there will be competing forces pulling the economy in two different directions: Inflation and deflation. However, I would argue that inflation is not done with us yet and that the Fed will have to hike a few more times to suppress it in the short term. In the long term, the viability of the US dollar is the issue, but that’s a discussion for another article…

If you would like to support the work that Alt-Market does while also receiving content on advanced tactics for defeating the globalist agenda, subscribe to our exclusive newsletter The Wild Bunch Dispatch. Learn more about it HERE.

High inflation means your 401(k) or IRA will be worth less, potentially much less, when you retire. Personally, I recommend a Gold IRA for the ultimate retirement security. To see why, Click here to get a FREE info kit from Birch Gold Group about Gold IRAs. (This comes with NO obligation or strings attached.)

You can contact Brandon Smith at:

You can also follow me at –

TwitterX: @AltMarket1

Gettr: @Altmarket1

13 Comments

YOU ARE A GOOD AND ATTENTIVE OBSERVER, of financial movements, rather of economic strategy, so complicated to be understood by the masses.

You leave a panoramic and in-depth look, analyzing how the globalist pyramid system works in collaboration with the exopolitical world.

We have to admit that they take a lot of trouble, they do a very serious job, they dedicate a lot of interest and effort, in carrying out all this dynamic of geopolitical, financial, and economic manipulation, so sophisticated and difficult to understand.

It seems that they have an instruction and use manual for all these manipulation tools that you mention and that are there in the great gear.

In my opinion, taking the exopolitical imagination to another level, possibly this project, these agendas applied here, have been tested and used on other planets.

They act like they already have experience, even though this all comes from way back in planetary history.

Of course, this is an issue that transcends our reality and our dimension of perception and it may seem absurd, but exopolitics exists.

The bankster’s best friend is inflation. They must have inflation and high interest rates to prop up the Dollar. Europe is in much worse shape than the US. War is their only way out, so they keep high interest rates and creating more Dollars. They know they can never pay the debt back, so as Alfred E. Newman famously said, “What? Me worry?” The US consumer will get the blame for the economic collapse. Just my two cents…

No, they are destroying the dollar deliberately to make way for their CBDCs and new global digital currency system. Inflation kills currencies – Always has, always will. The dollar and the US economy are their primary targets.

Brandon, I agree with you on destroying the dollar to bring about CBDCs. My question is what role do you see PMs playing after the rollout of the CBDCs?

It depends. I suspect certain countries will attach gold to their CBDC as a means to bolster initial value and make that currency more enticing than the dollar. Also, there will be a lot of red states that will at least be considering gold and silver as a currency alternative as the dollar declines. There will be some states that refuse to accept CBDCs altogether.

Regarding Europe, ECB policies and the “War on inflation”, here’s a very, very relevant interview:

https://goldswitzerland.com/after-svb-and-credit-suisse-collapse-bail-ins-next/

A few years ago, you wrote this: “What’s worse is that central bankers know exactly what they’re doing.” I couldn’t agree more, Brandon. The evidence is clear.

…

@Jeff M, “The US consumer will get the blame for the economic collapse”. Not only. I think we can include other scapegoats for the West’s economic collapse: the Russia/Ukraine “war”, “climate-related problems”, CV19 and a “new” health crisis, or another “black swan” (“aliens”?)…

The CBDS’s will be there way to enact even tighter slavery rules. You will not buy or sell without their permission. Where have we heard that phrase before? hmm…

I think it was in a book written a couple thousand years ago.

“Perhaps one of the most bizarre recent developments in economic news has been the attempt by establishment media (and the White House) to declare US inflation ‘defeated’ despite all the facts to the contrary.”

.

(True) Facts have never mattered to American State Media and the White House. Why, countless folks have made good and lucrative and lengthy careers over the years by just conjuring up and making up ‘Facts’ (of Their Own) to fit Their needs and agendas. Thinking back to the Dead Parrot Sketch on Monty Python… the American economy could be as dead as a doornail (like that Parrot) and American State Media and the White House will simply declare… ‘The Economy? It’s RESTING! I tell you… It’s NOT DEAD IT’S RESTING!’

.

You simply cannot believe in things like Facts and Reality to be able to work in and around American State Media and The White House. Entry into these Energy-Vampire organizations requires you to leave any notions of staying in touch with Reality at the front door once you’ve joined these Dark Siders. American State Media and The White House are Reality-Free Zones and always will be. They live in fantasy world of Their own making and they live out their lives in a blissful (but financially lucrative) fog.

.

Much of our lives is built around organizations that are built upon layer-upon-layer of fantasy and delusion. And nasty things like Reality can never be allowed in or the entire rickety structure of puff and fluff and vapor will quickly collapse down upon itself into a big heap of nothing.

.

And nobody in American State Media and The White House wants that.

Stagflation – Inflation in the things you must have (energy – gasoline/diesel, food, electricity, natgas, etc)…and deflation in the optional stuff (most of what is on the shelves in retail)

A good portion of retailers ordered surplus in 2022 because a good portion of the orders were unfulfilled. Many left those orders in place and ordered similar quantities for 2023. Now both years orders are being fulfilled while CCs are quickly reaching maxes….credit scores are falling…balances aren’t being paid off…and average interest rate is 21%.

Auto industry is in similar free fall.

Several respected analysts are predicting market collapse in 6-8 weeks. Reckon time will tell the story…however it unfolds…

Brandon explains the logical side of inflation about as well as anyone could. I firmly believe it is inflation (the new definition rise in cost of goods as opposed to traditional expanded money supply) which keeps TPTB up at night. They don’t give a rats ass about debt or printing money as long as inflation can be contained.

I had always assumed inflation was going to go bananas after the 2008 financial meltdown (money spending). Several years later I was quite puzzled as to why it was still under control. I shrugged and went on about my daily life until covid. It made ZERO logic to me how we could tell a huge section of the productive workforce to go into standby mode yet continue our lifestyles. I know some people were hurt but many made it through just fine. Some, also including the uber wealthy came out pretty well. I remember being gripped with fear late March of 2020 wondering how we would survive. Then introduced me to the art/skill of survival living or the struggle to learn it.

Well it turns out that America (W. Europe to a lesser extent) had essentially made themselves too big to fail. Our financial/monetary system had been firmly entrenched in most financial affairs of the world. Which leads us to the aspect of inflation that is much harder to define let alone account for; the abstract one. It is more of a game of confidence and faith. Here are some things that can erode it:

–Stolen elections

–Crumbling morale in government and institutions.

–Waning respect around the world

–Civil strife

I suspect most of you get the point. Now as the the world learns of the mighty US/NATO military machine is not invincible it only drives home the things I just listed. This is called “hanging on by a thread” as it will soon be evident we are. It is really hard to imagine something so large and powerful like the United States is losing its grip. The repercussions are really hard to fathom. That being said it must happen, and for the sake of humanity, that’s exactly what is going on.

Hey Brandon, again an article that is globally applicable, thank you for the heads-up.

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered…. I believe that banking institutions are more dangerous to our liberties than standing armies…. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.” -Thomas Jefferson-

Cash is King, Gold is God!

It seems the only real winners are those with income generating assets.

As bigger corporate fish swallow up the smaller independents, the worlds wealth is consolidated into fewer hands. That’s the goal. Covid was a great excuse to destroy a segment of the economy and only the biggest players seem to have done well. So many well known businesses in recent memory shut down or got bought up. One of my customer’s recently got bought by CBRE, which makes zero sense when you consider my customer is in the bio analytical business and CBRE is a commercial real estate powerhouse. To that I say the top brass at CBRE knows how to please the shareholders by selecting solid income generating assets.

Hey Brandon came across this last night. This man is already a legend IMHO. Yes I’m aware he may be a Russian Intel asset. I say perfect it’s nice to have a cheat sheet. This is really really good.

https://simplicius76.substack.com/p/russias-cbdc-exploring-the-truth